After

Business overview: Caesars Entertainment history and business content

Caesars Entertainment (NASDAQ: CZR) is one of the largest casino operations in the United States, operating 46 casinos (20 owned and 26 leased) primarily in Nevada. In 2020 they merged with the “Old Caesars” in a worthwhile deal About $17 billion. As a result, the new CZR increased net long-term debt from $2 billion to $10 billion (2019 vs. 2020), new financing obligations related to leases of $12 billion, and goodwill of $9 billion. I was. The merger resulted in a giant corporation that controls his 47,700 hotel rooms and his 2,900 table gas in the United States.

EBITDA increased from $700 million in 2019 to more than $2.9 billion in 2021 (post-Corona), while net leverage increased from 2.85x to 4.0x, allowing riskier companies to operate at lower margins of error. left at the scene. Cash flow hasn’t been strong either, and FCF has been consistently negative since the merger as the company’s spending on M&A far outstrips his CFO.

What is the position of shareholders after the merger? With the 2020 capital increase, approximately $3 billion of acquisition costs were supported by shareholders.

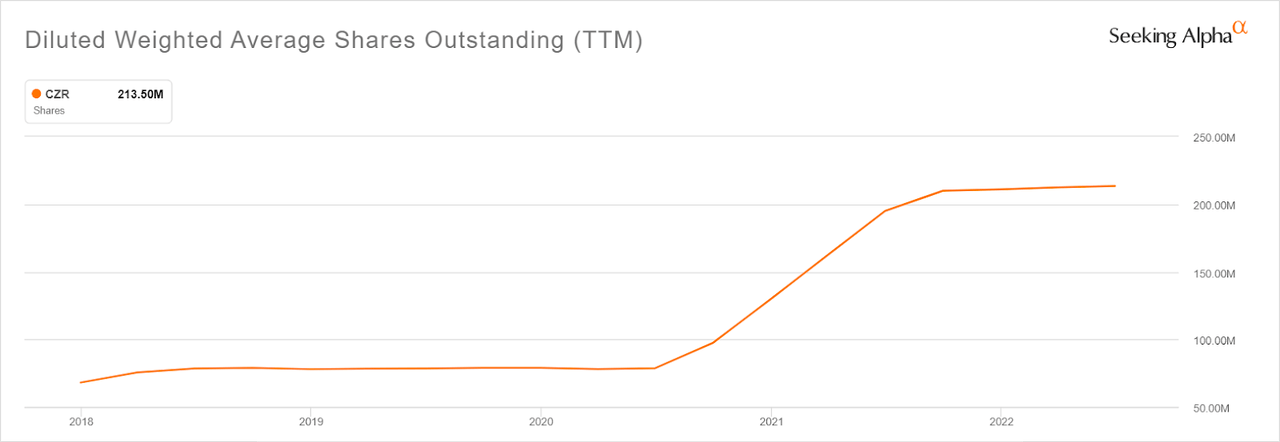

Number of issued shares (seeking alpha chart)

The number of shares outstanding has increased from 68 million at the end of 2017 to 213 million today, indicating a significant dilution of existing shareholders, whose weight (and voting rights) has decreased by approximately 70% . 10% owners in 2017 now only have 3% stake left.

Caesar’s Real Problem: Huge Balance Sheet Full of Floating Rate Debt

Caesars, like many other companies that require significant PP&E assets and capital expenditures, has a large amount of long-term debt on its balance sheet. This debt, primarily in the form of term loans and credit facilities, is the result of the merger completed in 2020.

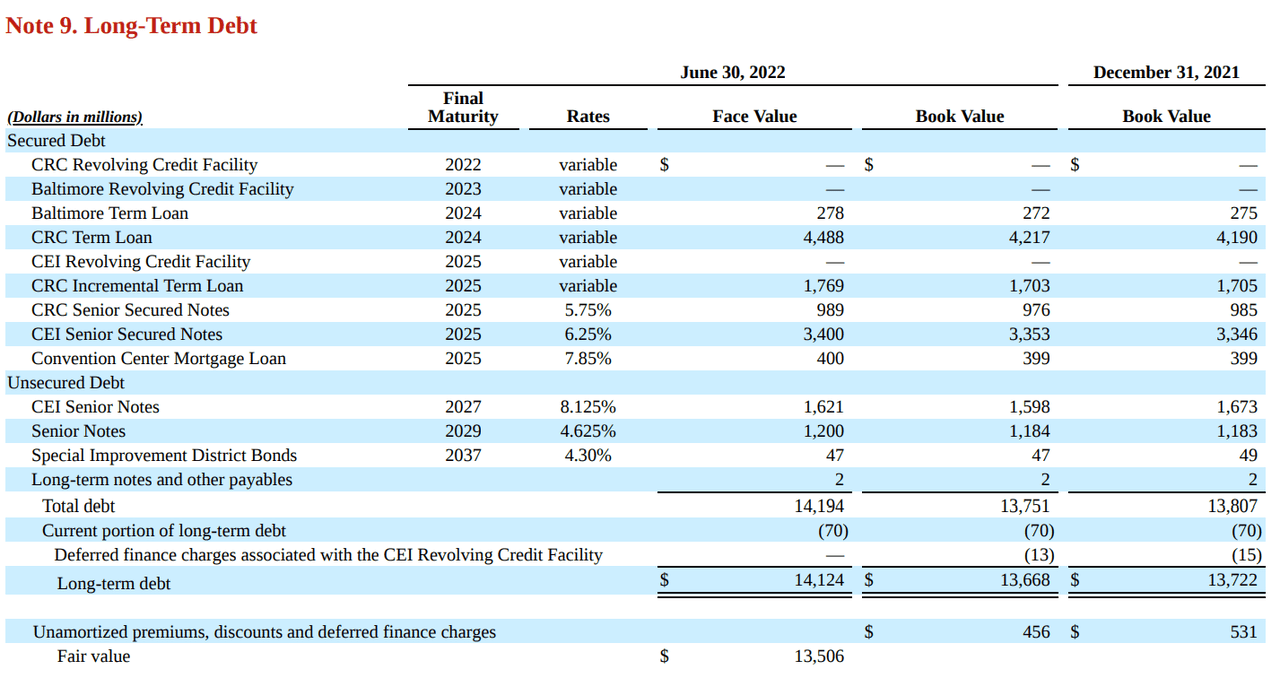

long term debt (CZR latest 10-Q )

This is what the facility looks like in filing. The main issue is clearly the variable interest rate, which he applies to six different properties, with a total book value of about $6.6 billion. Typically, companies like to cover by entering into interest rate swap agreements in case the Federal Reserve (FED) decides to hike his 3% rate in nine months. Instead, CZR is almost fully public, with swaps covering only $1.2 billion of floating rate debt and expiring in December 2022.

This means the company will be 100% exposed to $6.6 billion of variable debt from January 2023, with interest rates 3-4% higher than January 2022 (the amount the FED will continue to raise). depending on). Using an average increase of 350bps to calculate additional costs, CZR is expected to pay about $210 million to $230 million in additional interest. A debt balance of over $13 billion may seem reasonable, but it’s actually about 10% of what it will be in 2021. EBITDA and 17% of cash from operations.

For a company that already has a seriously negative FCF, this is definitely not a good addition to its expenses that will only further squeeze shareholder value.

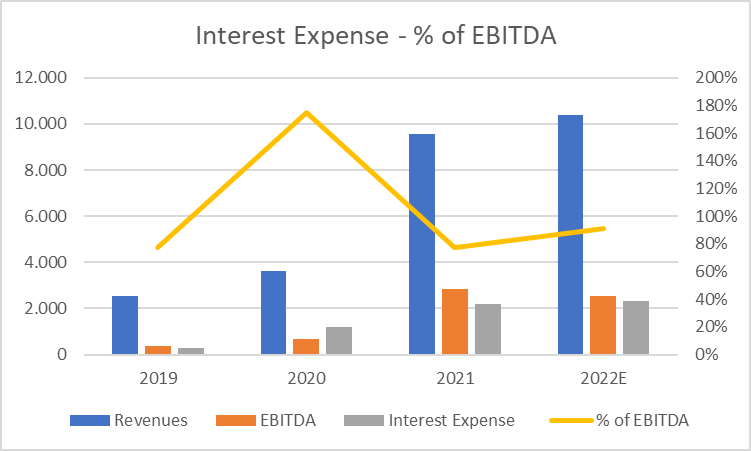

Interest expense (self-made chart)

This chart shows interest expense as a percentage of EBITDA, and it’s clear that the company is still struggling to contain interest expense even after a return to normal post-Covid conditions. In fact, he is expected to grow from about 80% of EBITDA to more than 90% in 2022 due to rising interest rates and a decline in his EBITDA.

Inflation: expect higher rents and lower income

As previously forecast, the company now operates 26 of its 48 casinos under lease agreements, which occurred after the merger was completed. In particular, VICI Properties is the main lessor of his 18 properties and is basically the landlord of the company. Their lease agreement has a dangerous (CZR) clause consisting of a rent increase based on his CPI (inflation) increase in the last financial year.

This means an 8-10% increase in $1.1 billion in rent costs starting January 2023. This translates to a $90-110 million increase in rent costs (actually expensed as interest).

And there is another important issue. How will demand be affected when inflation hits consumers? I am primarily aware of two issues. The direct effect of lower purchasing power and the indirect effect of higher mortgage interest burdens (due to higher interest rates). These two factors could lead to fewer trips to Vegas and less spending at Caesars stores. This could come in the midst of a very delicate and fragile trend back to pre-corona levels, with many statistics suggesting a recovery is still needed.

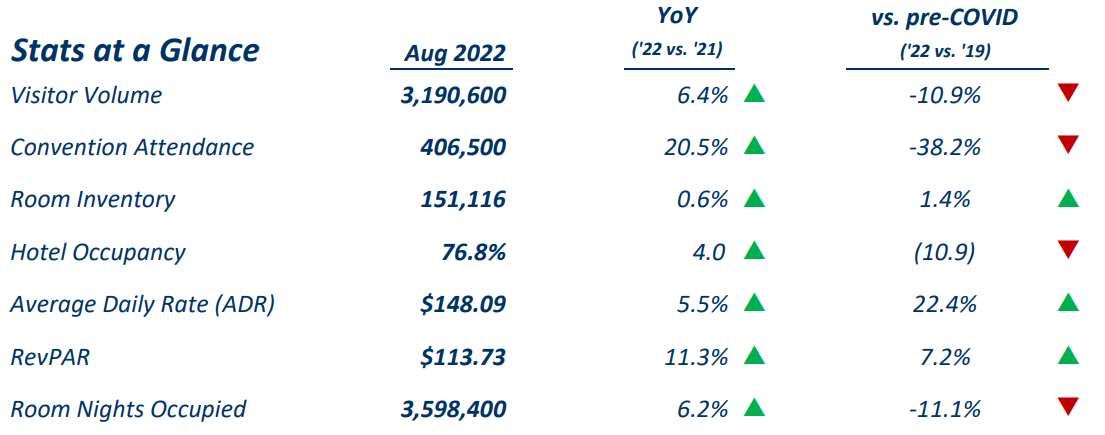

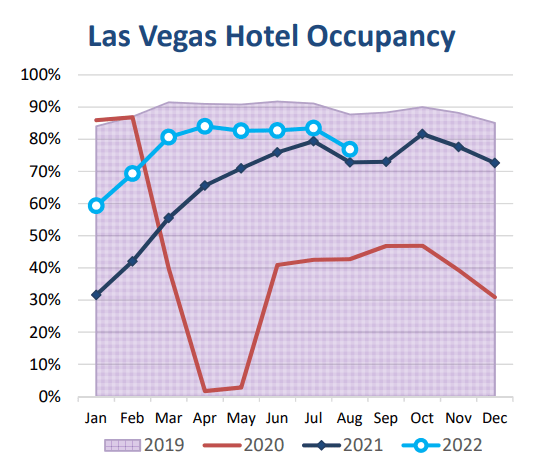

Las Vegas Tourism Statistics (LV CVA)

This official report, issued by the LVCVA authority, shows that visitor numbers are down 11% from 2019, and hotel occupancy rates (important for CZR) have declined in much the same way.

Las Vegas Tourism Statistics (LV CVA)

Inflation hitting the positive trend so far in 2022 could prove fatal for many casinos and hotels.

MODELING SCENARIO: CZR FAIR VALUE ASSESSMENT

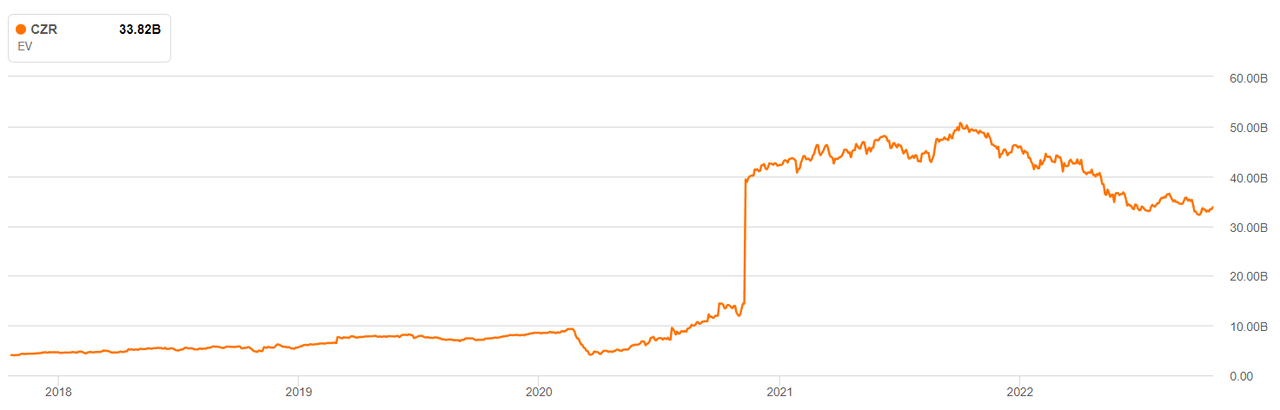

In recent years, Caesars’ EV, which completed the merger in 2020, has grown explosively.

CZR EV (seeking alpha chart)

It currently has assets of $33 billion, equity value of $8.5 billion and liabilities of $24.5 billion. Excluding debt derived from financial lease obligations, this last figure can be reduced to $14.5 billion (total EV of $23 billion).

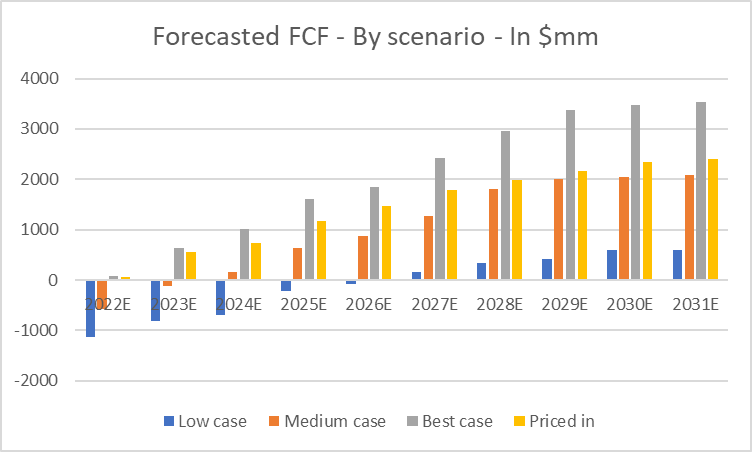

To properly value CZR, we run a DCF model with various scenarios (low, medium, best case) along with price-in scenarios derived from reverse engineering the current market value (i.e. market capitalization) of CZR stock. use. This priced-in scenario helps us understand the assumptions the market is (roughly) making about CZR’s future growth, margins and capex requirements. And ultimately, we expect distributable free cash flow. For a final $8.5 billion valuation, the market expects his CZR to have the following (according to my model):

-

14% (2022) to 3% (2026 onwards) growth rate.

-

EBITDA margin increased from 26% (2022) to 28% (2024 onwards).

-

FCF is between $57 million (2022) and $2.5 billion (end 2030).

To calculate FCF, we use net income instead of NOPAT to properly include interest expense arising from leases and LT obligations. This is an appropriate cost weighting for shareholders. With all of the above assumptions modeled, the fair share value would be $35 per share, close to the $39 that is currently trading. To give some perspective, the current pre-adjusted EBITDA margin is 23-24% over the last six months and 27% in 2021, but high-value acquisitions will push FCF to 3 in 2021 and 2020, respectively. It was negative $100 million and $6 billion. .

Let’s look at the assumptions for other scenarios.

-

Worst case: revenue growth of 3%, EBITDA margin of 12% (2022) to 14% (2024 onwards), FCF between -1.1 billion (2022) and $700 million (2030), Interest expense mainly due to uncoverable margins.

-

Medium case: Revenue growth of 10% (2022) to 2% (2026 onwards), EBITDA margin increasing from 21% in 2022 to 25% from 2026 onwards, FCF of -0.5 billion (2022 onwards) ) to $2.1 billion in 2030.

-

Best case: Revenue growth of 14% (2022), 5% (2024), 3% after 2024, EBITDA margin starting at 27%, 29% after 2026, FCF of $86 million ( 2022) to $3.5 billion (2030)).

CZR Prediction FCF (Self-made DCF model)

Here are the probabilities I assigned to each scenario:

-

Low case: $3 billion EV and $0 equity value. The probability of this scenario is 10%.

-

Medium Case: $16 billion EV, resulting in an equity value of $2.2 billion ($11.5 per share). The probability of this scenario is 70%.

-

Best case: $30 billion EV, resulting in an equity value of $16 billion ($80 per share). The probability of this scenario is 20%.

While this distribution clearly favors the best case scenario over the worst case scenario, the results are still very bearish, with an overall fair value (weighted average) per share of $24. suggests that there is Compared to the current stock price of $39, it’s down about 40%.

Conclusion

Caesars Entertainment is ill-positioned to face the current environment of rising interest rates, inflation and rents. In my opinion, relying on expensive floating rate debt to finance expensive acquisitions will quickly become negative in the form of lower CFO and FCF, which will materially harm shareholders. After calculating their fair value and considering all the factors that could put pressure on the company in the coming months, we conclude that CZR is a sell at a target price of $24. attached.

Comments

Post a Comment