kupiku

Overview

We recommend Sovos Brands purchase evaluation (NASDAQ: SOVO). It has a decent moat that stems from a portfolio of major brands and a clear growth strategy that has been repeatedly executed in the past.i believe in SOVO The current valuation could give investors a long-term IRR of 10% over the long term, but SOVO would be better off trading down to a lower valuation.

Company Profile

Sovos Brands is a leading U.S.-based food company focused on acquiring and building disruptive growth brands to bring delicious, lifestyle-inspired foods to the modern consumer. The company has adopted “one of a kind” branding to ensure the highest quality. As a result, each SOVO brand offers its guests an authentic, authentic and unforgettable dining experience. Additionally, his SOVO commitment to employee well-being is at the core of the company. SOVO gives your team the tools they need to become brave and persistent leaders. This gives you the confidence and flexibility to build relationships with customers and retail partners that help grow your business.

SOVO believes that the combination of “unique” products and talented people will ultimately make SOVO a “unique” company. This will enable SOVO to achieve its goal of developing a growing and sustainable food company that generates more financial growth than its competitors.

US customers make up the majority of SOVO’s consumers. These customers include traditional supermarkets, mass merchandisers, warehouse clubs, wholesalers, specialty food distributors, military outlets, and non-food stores such as drug stores, dollar stores, e-commerce retailers .

attractive business model

SOVO’s business model is based on acquiring ‘own’ brands and leveraging common infrastructure and shared playbooks to drive development and growth. The beauty of the brands SOVO has purchased is that they all have one important thing in common. For example, it tastes good, it has a strong customer following, it can shake up established categories, and it can use its brand power to expand into other categories.

In general, consumers who are younger, more family-oriented and with higher disposable incomes are more likely to purchase SOVO brands. Third-party surveys sponsored by the company show that SOVO’s customers have a strong love for taste and quality, place great emphasis on using clean ingredients, and have larger shopping baskets than the average category in the market. I use it in retail.

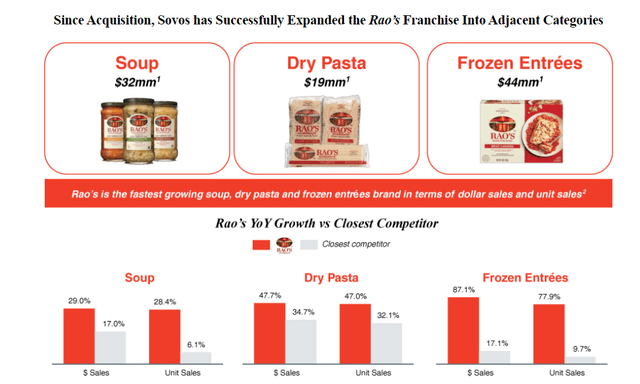

All of SOVO’s brands follow the same growth strategy, focused on increasing home penetration through increased brand awareness, expanded distribution, enhanced sales and marketing execution, and innovation into new categories. It is clear. I think the popularity of Rao’s brand is an example of how SOVO has grown.

prospectus

SOVO has proven its ability to drive growth through M&A. Looking back, SOVO has successfully completed four different acquisitions in the last four years. The company uses selection criteria when evaluating potential acquisition targets, beginning with what it takes to become a Sobos brand. Since its inception, SOVO has conducted these assessments for over 200 brands, as described in its prospectus. With a systematic approach and a wealth of experienced industry specialists, SOVO believes he will continue to grow through his M&A and add brands to his portfolio that will increase in value over time.

Ultimately, SOVO’s past acquisitions were successful. This is because the company has improved each brand it has acquired, expanded TAM, saved money, increased employee productivity, and found synergies.

Strategic Partner of Retailers

I think retailers see value in SOVO’s brand and strategy. The company’s retail customers love its premium price points and strong sales velocity, giving investors a large gross margin per unit. Affordability will grow in the center store category, giving SOVO greater access to a wide range of demographics and retail classes. The company firmly believes that its compelling value proposition for retailers offers significant opportunities to expand distribution across its portfolio.

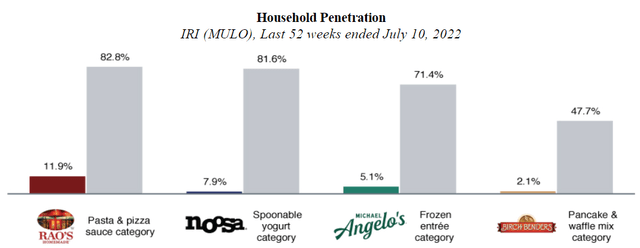

Plenty of room to continue penetrating home demand

SOVO can continue to increase home penetration. I think SOVO has a clear and tangible opportunity to increase the home penetration of each brand. Looking at Rao’s in SOVO, he had 11.9% penetration of this brand’s sauce into business households in his 52 weeks to July 10, 2022, compared to his 82.8% in the sauce category. . For Rao’s pasta and pizza sauces, 1% household penetration equates to approximately $54 million in retail sales over the same period. Below are household penetration rates for other major Sovos brands for 52 weeks (ending 10 July 2022).

- Noosa’s spoonable yogurt was 7.9%, and 81.6% of its category.

- Frozen entrees from Michael Angelo scored 5.1%, compared to 71.4% for that category.

- Birch Benders pancake and waffle mix was 2.1% and 47.7% for its category.

prospectus

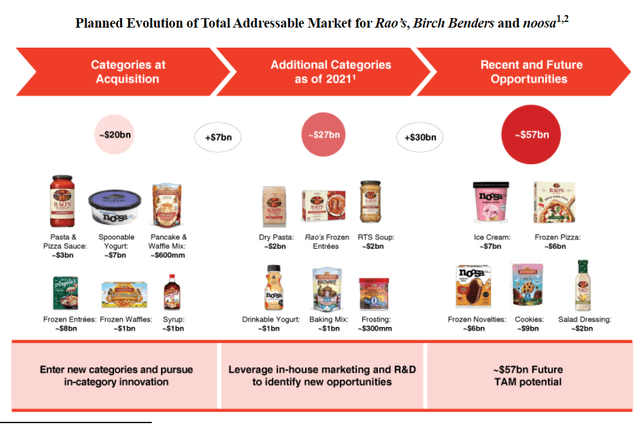

Strong culture of innovation drives SOVO to penetrate $57 billion TAM

Continuous innovation is ingrained in SOVO’s culture and is an integral part of the company’s strategy for creating value. The company’s integrated marketing, research, and development teams proactively identify new opportunities for businesses to build unique use opportunities for their brands by leveraging existing brand strengths and infrastructure. increase. We believe SOVO has grown faster than most CPG companies. According to management’s estimates, SOVO’s portfolio as a whole will grow from about $20 billion to about $27 billion by December 2021, expanding the brand’s total market reach by about $7 billion to enter new categories. Successful. We are expanding nationally into new product categories including ready-to-eat soups, frozen entrées, dehydrated pastas, drinking yogurts, baking mixes and frostings. These new product categories were introduced after the company acquired the brand.

prospectus

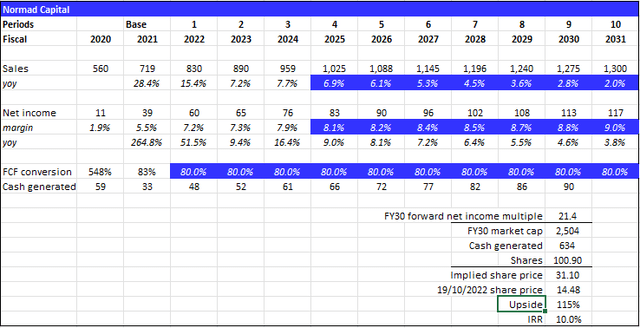

evaluation

With a current stock price of $14.48 and 109 million shares, the market cap is ~$1.4 billion. I believe the current valuation is slightly tilted towards fair value and a better entry point would be when it trades down. You can still expect his IRR of up to 10%. I would like to emphasize that my model does not account for significant growth from acquisitions as it is difficult to predict. So the acquisition could make the IRR better than I expected.

I believe SOVO will achieve $1.3 billion in revenue and $103 million in net income in fiscal year 2031. This is due to sales growth dropping from his FY24 consensus forecast to his FY31 long-term inflation rate of 2%. Net profit margins will remain flat for him in 2024 and beyond, and assuming the company trades at 21x in FY2030, its $2.6 billion market cap and FY2030 stock price will be $31.1.

Assumptions:

- Sales: Following management guidance in FY22 and consensus forecast through FY24. It then tapers off over a decade as growth slows due to market saturation and lack of acquisition targets.

- Net Profit: Expands in line with consensus forecasts through FY24, growing to industry-level 9% over the long term.

- Valuation: We assume no change in valuation and should continue to be valued using the current futures earnings multiple of 21x for FY2030.

Nomad Capital

dangerous

competitive industry

SOVO competes with large multi-brand consumer packaged food companies, smaller single-product producers, development companies, and companies focused on dairy and dairy alternatives. I’m here. There are many brands and products competing for shelf space and sales.

Value Destroying Acquisition

Currently, SOVO may not be able to properly integrate and manage the acquired brands and may not be able to realize the budgeted costs and targeted synergies of the acquisition within the expected timeframe. There are many potential downsides to corporate acquisitions.distribution; purchases, etc.

Changes in consumer tastes

SOVO’s success depends on continued demand for premium, on-trend, high-quality products. Any reduction in that demand could adversely affect the Company’s operations, financial condition and results of operations.

Conclusion

As a food company with a ‘unrivaled’ image, SOVO will not be afraid to innovate and will continue to produce unrivaled premium foods. Scale your value creation to reach more consumers and continue to grow through acquisitions in the face of tough competition, M&A risk, and unpredictable market shifts with calculated risk at each step. I have to take it.

Not only the company’s attractive business model, but also its strategic positioning in retail partners, growing household demand, and having an innovative culture, investors invest not only in products and profits, but also in reputable businesses. We want to grow. As an employee, you need to know more about SOVO and how the company doubles its value as it doubles its brand. The current valuation isn’t ideal, but it could still bring investors his 10% long-term IRR.

Comments

Post a Comment